Bernie Madoff and the ineptitude of our watchdogs.

Checks and balances, right?! Well, what happens when the watchdogs are blind?

The story of Bernie Madoff and his massive Ponzi scheme is indeed a significant event in financial history. Madoff's case highlights not only the actions of an individual driven by personal motives but also the failures of regulatory bodies and the devastating impact on the lives of those affected.

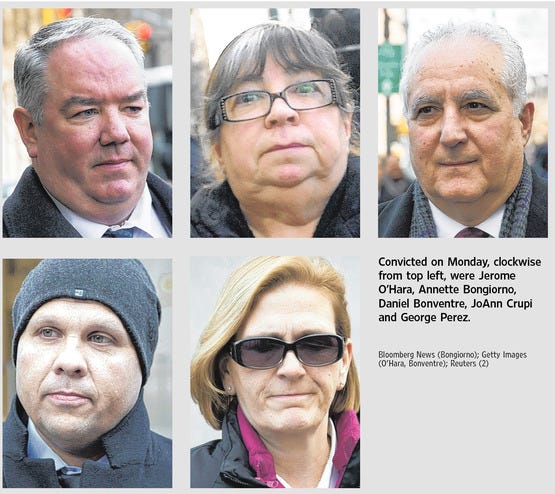

Madoff was able to perpetrate his scheme for so long due to several factors. One key element was the involvement of loyal employees, often recruited from a young age. These individuals, known as the "Madoff Five," worked closely with him on the 17th floor, where much of the fraudulent activity occurred. While they pleaded not guilty and maintained their innocence, their roles in creating fictitious trading records and software programs to cover up the scheme raise suspicion.

It is difficult to ascertain the extent to which these individuals were complicit or aware of the fraudulent activities. Nevertheless, their involvement and the absence of red flags in their actions raise questions. People can become blinded by a particular lifestyle or the belief that upper management wouldn't instruct them to do anything illegal. However, one would expect them to recognize that something was amiss, especially when asked to create false records or obstruct investigations.

The Madoff Five, including Annette Bongiorno (sentenced to 6 years), Daniel Bonventre (Sentenced to 10 years), JoAnn Crupi (Sentenced to 6 years), Jerome O'Hara (sentenced to 2.5 years), and George Perez (also sentenced to 2.5 years), received benefits from Madoff, and some even had their weddings or other events financed by him. Their complicity or lack thereof remains a matter of speculation, as the full truth might never be revealed.

Additionally, Jeffry Picower played a significant role in the scheme’s longevity. Had he not intervened multiple times over the years, the scheme might have collapsed much earlier. However, his death under suspicious circumstances, conveniently timed to avoid legal actions, raises further questions. Picower, who was being sued by the trustee responsible for returning funds to Madoff's victims, sought to dismiss the lawsuit before his demise.

The ineptitude of the Securities and Exchange Commission (SEC) is another crucial aspect of the Madoff case. Harry Markopolos, a whistleblower, repeatedly warned the SEC about Madoff's fraudulent activities, even providing detailed explanations and evidence of the Ponzi scheme. However, his warnings were largely ignored or brushed aside, highlighting the SEC’s lack of understanding and action. This failure to comprehend the complexities of the financial industry and respond adequately to credible warnings contributed to the scheme's prolonged existence.

The Madoff case serves as a stark reminder of the devastating consequences that arise from both individual greed and systemic failures. It raises questions about the effectiveness of regulatory bodies and the need for enhanced oversight and accountability in the financial sector. While preventing another Ponzi scheme of the same magnitude may be challenging, it is crucial to learn from past mistakes and continuously improve the systems in place to protect investors and the general public.

All said and done, there’s an estimated $20 billion that was stolen in assets by Bernie Madoff. Of which approximately $13.6 Billion has been returned since the time of the article in 2021

Unfortunately, we’re learning how easy it is for people and organizations to be persuaded by charisma, a winning personality, and ‘captivating results.’ After all, within the last year, we recently dealt with the FTX debacle concerning Sam Bankman-fried. He was referred to in some regards as the Bernie Madoff of crypto.

And in one particular case, it was by someone who knew Sam and his family and considered him a close friend.

In fact, the person is quoted as saying this

“I thought Sam was the Mark Zuckerberg of crypto, I did not think he was the Bernie Madoff of crypto," he added. "And I got that wrong.”

So, right there, we may very well answer the previously mentioned inquiry… “Could we see another incident on this level occur in the modern world of finances?”

Links to resources for the article:

https://www.bustle.com/entertainment/who-went-to-jail-for-the-bernie-madoff-scandal

https://www.wpbf.com/article/cause-of-jeffry-picower-s-death-determined/1303092

https://www.sec.gov/news/studies/2009/oig-509/exhibit-0269.pdf

https://www.npr.org/2010/03/02/124208012/madoff-whistleblower-sec-failed-to-do-the-math

https://www.cnn.com/2021/04/14/business/bernard-madoff-ponzi-scheme/index.html

https://www.businessinsider.com/sam-bankman-fried-compared-to-bernie-madoff-by-anthony-scaramucci-2023-1?op=1